how does irs collect back taxes

GAP interest is the interest that accrues on the priority tax debt like back payroll tax trust fund taxes between the time that the bankruptcy petition is filed and the time that the reorganization. Annuity payout after taxes.

Filing Back Taxes What To Know Credit Karma Tax

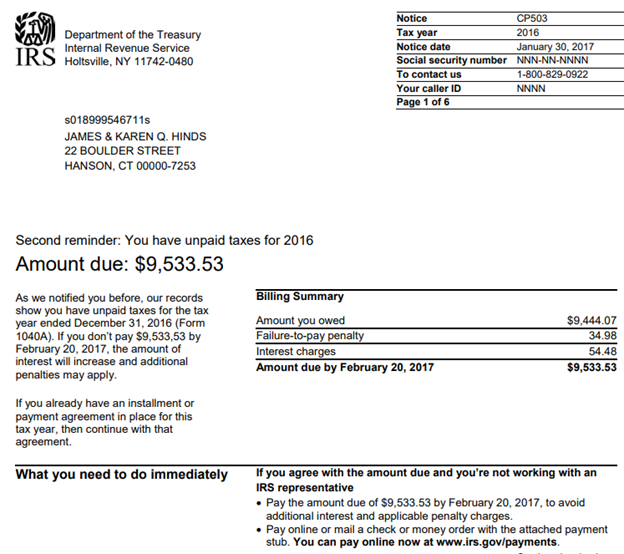

A 10000 to 50000 tax debt is no small number and the IRS takes these sorts of unpaid balances seriously.

. Does the IRS collect. Some of the actions the IRS may take to collect taxes include. The overall odds of winning a prize are 1 in 249 and the odds of winning the.

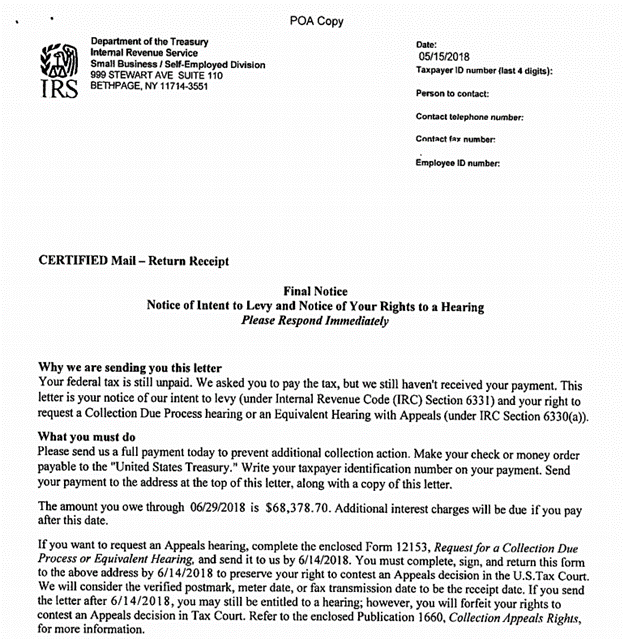

Filing a Notice of Federal Tax Lien Serving a Notice of Levy. Theyll start by charging late penalties as well as failure to file penalties if. Taxpayers can set up IRS payment plans called installment agreements.

485 66 votes Some of the actions the IRS may take to collect taxes include. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. After that the debt is wiped clean from its books and the.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax whichever is later if you file a claim for credit or refund after you file your return. What to do if you owe the IRS a lot of money. The IRS will first send Notice CP40 and Publication 4518 PDF.

The best option is always to find ways to pay your taxes or discuss payment plans with the IRS. The federal tax lien occurs as part of the IRS collection process after the IRS has sent notice of your tax balance due and you do not settle your total back taxes amount. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years.

Set up an installment agreement with the IRS. A tax assessment determines how much you owe. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment.

You can get your transcript by calling the IRS at 800-829-1040 or by visiting their website through the IRS online portal available at. Once a lien arises the IRS generally cant release the lien until the tax penalty interest and recording fees are paid in full or until the IRS may no longer legally collect the. Lump sum payout after taxes.

The IRS offers several options for taxpayers who cannot immediately pay unpaid taxes. You may be able to find tax relief through what is called an offer in compromise This allows you to settle your back taxes with the IRS for less than. These let you know that your overdue tax account was assigned to a private collection agency.

This time restriction is most commonly known as the statute of limitations. They will begin to notify you about your debt and ask you to pay up. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

The IRS will first attempt to collect your back taxes by sending you balance due notices in the mail and giving you the chance to pay your tax debt in full or make payment. After that the debt is wiped clean from its books and the IRS writes it off. Filing a Notice of Federal Tax Lien Serving a Notice of Levy.

This is a free service that the IRS offers. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. Offsetting a refund to.

The good news is that the IRS cant pursue collections from a taxpayer forever. How does IRS collect back taxes. Whether the IRS is going to haunt them for the rest of their lives is a very common concern.

What Is the IRS Collections Statute of Limitations. Does the IRS forgive tax debt after 10 years. The ideal tax relief option or IRS restart program that works for you depends on the amount of tax you.

As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. Serving a Notice of.

Irs Accepts Offer In Compromise In Marshfield Mo 20 20 Tax Resolution

Beware The Irs And New York State Tax Collection Arsenal Takeaways From The Boom Conference Tenenbaum Law P C

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

How Social Security Garnishment Works With Federal Back Taxes

My Husband Owes Taxes Spouse And Tax Debt Liability

5 Steps To Pay Owed Back Taxes Ooraa Debt Relief

How Long Does The Irs Have To Collect Back Taxes Brinen Associates

How Do I Know If I Owe The Irs Debt Om

How Far Has The State Gone Back For Failure To File Taxes Priortax

Column The Irs Hired Bill Collectors To Collect Back Taxes And Got Ripped Off Los Angeles Times

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Do I Have Tax Refund Money From 2017 Irs Sitting On 1 3 Billion Kens5 Com

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

What Does The Irs Do And How Can It Be Improved Tax Policy Center

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Nuclear War The Irs Will Be Back To Collect Taxes In One Month Irsprob Com Randell W Martin Cpa Pllc

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes